You may not have been traveling much over the last couple years. And while you may not have much on your travel calendar for early 2022 yet, the year holds so much promise. So, now is the time to make sure you have the best credit card for travel in 2022 in your wallet. There are so many different best credit cards for travel available. And yet, each one offers slightly unique benefits that will make one of them better for you than all the others. So, whether you are looking for the best credit cards for international travel or just best credit cards for travel rewards, you should find exactly what you need on this list. Then you can apply for the best travel credit card for your needs and have it ready when you start to head out on adventures once again.

10 Best Credit Cards for Travel in 2022

The Chase Sapphire Preferred Card is one of the better credit cards for travel right now. When you use this card, you earn an excellent return on all your travel and dining expenses. The best part is that all the benefits you receive really offset the cost of the annual fee of $95.

Pros - Chase Sapphire Preferred

- 3x the points on dining and 2x the points on all travel with the exception of travel booked through Chase Ultimate Rewards (5x the points)

- $50 Ultimate Rewards Hotel Credit

- No delivery fees for all $12+ orders using DashPass

- Includes lost luggage insurance, auto rental collision damage waivers, and trip cancellation and interruption insurance

Cons - Chase Sapphire Preferred

- $95 annual fee

More details:

- 60,000 bonus points when you spend $4,000 on purchases during the first 3 months your account is open.

- Benefits include $50 Ultimate Rewards Hotel Credit annually, 3 times the points on all dining purchases, and 5 times the points on all travel booked through Chase Ultimate Rewards

- Your points are worth 25% more when you book your travel through Chase Ultimate Rewards

- Unlimited zero-dollar delivery fees when placing orders for $12+ using DashPass

- You can always count on being covered for lost luggage, car rental collision damage, and trip cancellation and interruption

The Chase Sapphire Preferred Card now tops the list of the best credit cards for travel in 2022. This credit card does have a $95 annual fee, but the benefits far exceed the amount you must pay each year.

Every time you use your Chase Sapphire Preferred Card for travel, you will earn rewards. Most travel purchases are equal to two times what you spend. However, dining is three times what you spend, and all travel purchased through Chase Ultimate Rewards is five times your cost. You will also receive perks that include an annual Ultimate Rewards Hotel Credit of $50.

Currently, you will receive 60,000 bonus points when you spend $4,000 on purchases within the first three months of your account being open. Any rewards you earn can be redeemed for hotels, airline tickets, rental cars, and cruises. It is best to redeem through Chase Ultimate Rewards, because then your points are worth 25% more. You can also redeem your rewards for statement credits if you wish.

Other benefits of this travel credit card include lost luggage insurance, auto rental collision damage waiver, and trip cancellation and interruption insurance. You will also have no delivery fees on any orders you place for more than $12 using DashPass.

Click here to apply for the Chase Sapphire Preferred card

The Capital One Venture Rewards Card is always at the top of my list when choosing a travel reward card. There is a $95 annual fee, but that cost is instantly offset with a $100 credit for either TSA PreCheck or Global Entry. Once you add in all the other perks of this travel credit card, you will see why it is always my number one choice.

Pros - Capital One Venture Rewards

- $100 credit for TSA PreCheck or Global Entry

- 2 miles per dollar you spend on anything

- All travel booked through Capital One Travel earns you 5 miles per dollar

- No blackout dates when redeeming your rewards

- No foreign transaction fees

Cons - Capital One Venture Rewards

- $95 annual fee

More details:

- 60,000 bonus miles when you spend $3,000 on purchases within 3 months of opening your account

- Earn 2 miles per dollar on any purchase you make – This goes to 5 miles per dollar for any travel you book directly through Capital One Travel

- All miles can be redeemed for airline tickets, hotel stays, rental cars, and so much more. And there are never any blackout dates!

- No foreign transaction fees

- Easily transfer miles to 15 other loyalty programs Capital One works with

The Capital One Venture Rewards Card may have fallen slightly down the list for best travel credit cards in 2022, but it is still an excellent option. There is a $95 annual fee for this card, so you will want to keep that in mind when you fill out the application. Thankfully, you can get a return on your money quickly with all the benefits of this travel card. The one perk you will love, especially if you travel a lot, is the $100 credit for TSA PreCheck or Global Entry. And that credit will basically cover your annual fee for the year!

When you use your Capital One Venture Rewards Card, you will earn 2 miles per dollar you spend. If you happen to book your hotels and rental cars through Capital One Travel, your rewards are instantly boosted to 5 miles per dollar.

You can currently earn 60,000 bonus miles if you spend $3,000 on purchases within the first three months of having the card. You can redeem those bonus miles, and other miles you earn for airline tickets, hotel stays, rental cars, and so much more. There are never any blackout dates when you redeem your Capital One rewards. Your miles will never expire either, as long as your account remains open.

There are never any transaction fees when you use this travel credit card internationally. And you can easily transfer your miles to any of the fifteen travel loyalty programs Capital One works with.

I use this card and find it to be the best credit card for international travel. Here’s an additional bonus they just started in 2021: You can now use your accumulated points to purchase on Amazon. Wow! I have really used that.

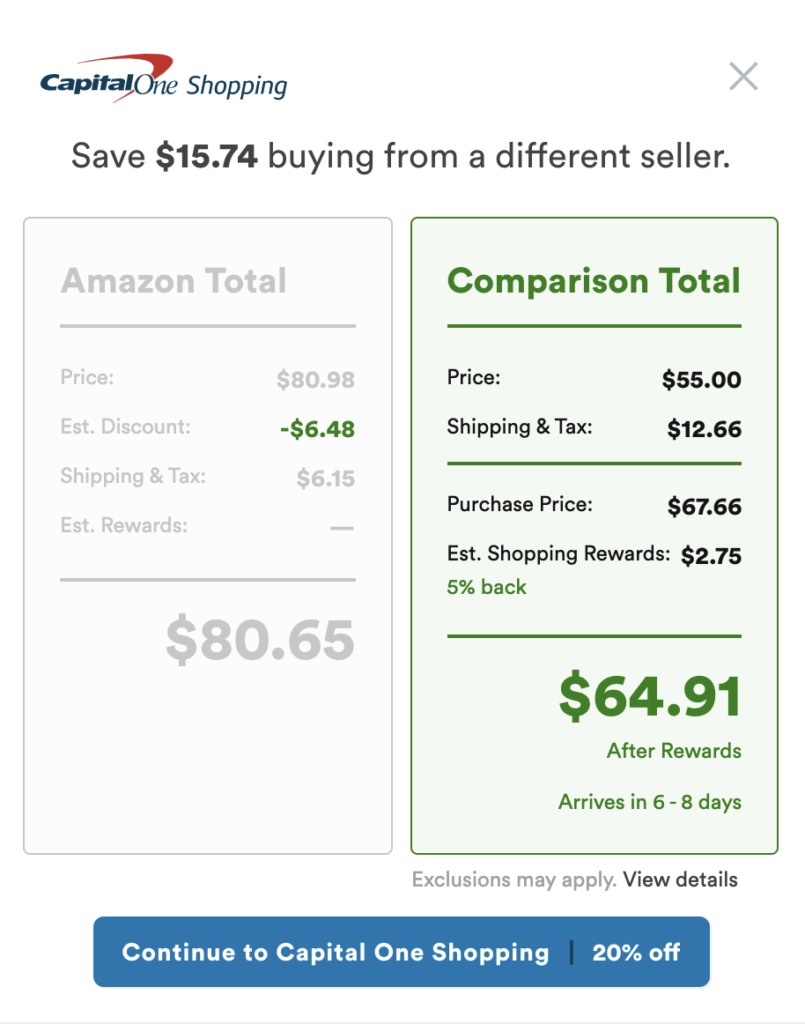

Additionally, they have a browser plugin for Chrome that will check prices and give you recommendations to save money. For example, I search for something on Amazon, and the Capital One plugin informs me that I can save by buying else where.

Get your Venture Rewards credit card from Capital One by clicking here.

The extra points you receive for travel purchases, as well as the points you earn for every dollar you spend are what piqued my interest in this card. While there is an annual fee of $95, the annual hotel savings benefit helps cover that cost quickly.

Pros - Citi Premier Card

- Annual hotel saving benefit

- 3 points for every dollar spent on all air travel and money spent at hotels, gas stations, restaurants, and grocery stores

- No foreign transaction fees

Cons - Citi Premier Card

- $95 annual fee

More details:

- 80,000 bonus points can be earned when you spend $4,000 in purchases within 3 months of opening your card

- 3 points per dollar spent on all air travel, hotels, gas stations, restaurants, and grocery store purchases. 1 point per dollar on all other purchases

- Annual hotel saving benefit

- No foreign transaction fees

- All points can be redeemed for gift cards through thankyou.com

The Citi Premier Card also has a $95 annual fee. When you use this credit card, you will earn 3 points for every dollar you spend for air travel, hotels, gas stations, restaurants, and grocery stores. And if you happen to shop anywhere else, you get 1 point for every dollar you spend.

If you spend $4,000 in purchases during the first three months of opening your Citi Premier Card, you will receive 80,000 bonus points. There is never no limit in the number of points you can earn, and they never expire as long as your card is open. All your points can be redeemed for gift cards through thankyou.com.

Another perk of this credit card for travel is there are never any foreign transaction fees when you make purchases internationally. The annual hotel savings benefit is also part of this package.

Click here to apply for the Citi Premiere card.

Pros - American Express Platinum card

- 5 times the rewards on all travel booked through American Express Travel

- $200 hotel credit

- $240 digital entertainment credit

- $155 Walmart+ credit

- $200 airline fee credit

- $200 Uber Cash

- $300 Equinox Credit

- $179 CLEAR Credit

Cons - American Express Platinum card

- Very high annual fee of $695

More details:

- Receive 100,000 membership bonus points when you spend $6,000 on purchases within 6 months of opening your account

- During that same 6 months, you earn 10 times the points at all restaurants and small businesses you shop at

- 5 times the rewards on all travel booked directly with airlines or through American Express Travel

- Tons of other perks that include $200 hotel credit, $200 airline credit, $200 Uber Cash, $240 digital entertainment credit, $155 Walmart+ credit, and $179 CLEAR credit

The American Express Platinum Card does have a hefty annual fee at $695. But the perks may have you saving much more money than that every year. If that is the case, then this card could be perfect for you. Earning points is simple when you use this travel credit card. You can get 10 times the points at all restaurants and when you shop at small businesses during your first six months. Five times the rewards is earned when you book directly with airlines and American Express Travel.

Right now, you can earn 100,000 membership reward points when you spend $6,000 on purchases during the first six months. Other membership perks include a $200 hotel credit, $240 digital entertainment credit, $155 Walmart+ credit, $200 Airline fee credit, $200 Uber Cash, $300 Equinox Credit, and $179 CLEAR Credit.

To apply for the American Express Platinum card, click here.

Pros - Chase Sapphire Reserve Card

- 5 times the points on air travel

- 10 times the points on hotels and car rentals

- Access to more than 1,300 airport lounges

- $100 credit for TSA PreCheck or Global Entry

- Insurance for lost luggage, trip cancellation or interruption, and auto rental collision damage

Cons - Chase Sapphire Reserve Card

- Very high annual fee of $550

More details:

- Earn 50,000 bonus points when you spend $4,000 in purchases within 3 months of opening your account

- Chance to earn 5 times the points on air travel and 10 times the points on car rentals and hotels once you spend $300 on travel annually

- Dining purchases earn you 3 times the points and all other purchases are 1 point per dollar

- Redeem your points through Chase Ultimate Rewards will increase the value of your points by 50%

- $100 credit for either TSA PreCheck or Global Entry

- Access to more than 1,300 airport lounges, so you can be comfortable while traveling

- Trip cancellation or interruption insurance, lost luggage insurance, and auto rental collision damage waivers

The annual fee for the Chase Sapphire Reserve Card is a hefty one at $550. All your travel and dining purchases will give you 3 times the points, while all other spending is worth 1 point per dollar you spend. And after you spend $300 on travel annually, you can earn 5 times the points on air travel and 10 times the points on hotels and car rentals.

You can earn 50,000 bonus points when you make $4,000 on purchases during the first 3 months. Redeeming your points is simple too. You can choose to redeem them through Chase Ultimate Rewards, which gives your points 50% more value when you redeem for travel. You can also choose statement credits or to transfer your points to another airline or hotel loyalty program.

Other perks of the Chase Sapphire Reserve Card include access to more than 1,300 airport lounges, $100 credit for TSA PreCheck or Global Entry, trip cancellation and interruption insurance, lost luggage insurance, and auto rental collision damage waiver.

To apply for the Chase Sapphire Reserve card click here.

Anyone looking for a travel rewards credit card without an annual fee should definitely consider the Capital One VentureOne Rewards Card. You may not receive too many miles for every dollar you spend, but you won’t have a hefty fee to pay once a year either. The best part is you can combine your miles from this travel credit card with miles from any of the fifteen loyalty programs Capital One works with.

Pros - Capital One VentureOne Rewards card

- No annual fee

- 5 times the miles for all hotel stays and car rentals you book through Capital One Travel

- Transfer your miles to any of the 15 loyalty programs Capital One works with

Cons - Capital One VentureOne Rewards card

- Only earn 1.25 miles for every dollar you spend

If you do not think you travel enough to warrant paying an annual fee for a travel credit card, you may want to consider the Capital One VentureOne Rewards Card. This card has a zero-dollar annual fee. And yet, you still receive quite a few perks of having a credit card for travel.

When you make purchases using this card, you receive 1.25 times the miles for every purchase. And if you book your hotel stays and rental cars through Capital One Travel, you will earn five times the miles on those purchases. You can use your miles to be reimbursed for any travel purchase you make or to book travel through Capital One Travel.

Your miles will never expire, as long as your account is active. Plus, you can transfer your miles to any of the fifteen travel loyalty programs Capital One works with.

Currently, you can receive 20,000 bonus miles when you spend $500 on purchases within the first 3 months of opening your account.

To apply for the Capital One VentureOne Rewards card, click here.

Pros - American Express Gold card

- 4 times the points on all purchases at grocery stores and restaurants

- 3 times the points for all flights booked directly with airlines and travel booked through amextravel.com

- $120 in Uber Cash

Cons - American Express Gold card

- $250 annual fee

More details:

- Earn 60,000 bonus points when you make $4,000 in purchases within the first 6 months of opening your card

- 4 times the points on all dining and grocery store purchases

- 3 times the points on all flights booked directly with airlines and all travel booked through amextravel.com

- $120 in Uber Cash

- $120 dining credit

American Express seems to have some hefty annual fees for their travel credit cards. But those fees are worth it when you see the benefits you receive with each individual card. The annual fee for the American Express Gold Card is $250. Currently, you can earn 4 times the points on all purchases at restaurants and grocery stores and 3 times the points on flights booked directly with airlines, and any travel booked through amextravel.com.

If you spend $4,000 on purchases within the first 6 months of opening your card, you receive 60,000 bonus reward points too. Other benefits include no foreign transaction fees, $120 in Uber Cash, and $120 dining credit.

To apply for the American Express Gold card, click here.

The Bank of America Travel Rewards Card is another credit card for travel that does not have an annual fee. That alone is why it gets into the top 10 travel credit cards for 2022. One of the perks of having this credit card for travel is you can simply use your points for future statement credits for any travel or dining expenses. The low introductory APR is also a helpful feature of this card.

Pros - Bank of America Travel Rewards card

- No annual fee

- All points can be used for statement credits

- Low introductory rate

- No foreign transaction fees

Cons - Bank of America Travel Rewards card

- Low point earning potential – currently at 1.5 points for every dollar you spend

More details:

- Earn 25,000 bonus points when you make $1,000 in purchases within 90 days of opening your account

- 1.5 points earned for every dollar you spend

- Points can be redeemed for all travel and dining expenses on future statements

- No foreign transaction fees

- Opportunity to become a Preferred Member to earn even more points

The Bank of America Travel Rewards Card has a zero-dollar annual fee. This makes it one of the better credit cards for travel. You can currently earn 1.5 points for every dollar you spend. And if you make at least $1,000 in purchases within 90 days of opening your account, you will receive 25,000 bonus points.

Your bonus points can be used as a statement credit for any travel or dining related expenses.

There is a low introductory APR for this credit card right now. There are no foreign transaction fees either. You will also have the opportunity to become a Preferred Rewards Member, which will allow you to earn even more points on every purchase you make.

To apply for the Bank of America Travel Rewards card, click her.

Pros - Chase Ink Business Preferred card

- 3 times the points for every dollar spent – for the first $150,000 you spend each year

- Fraud protection

- Zero liability

- Purchase protection

Cons - Chase Ink Business Preferred card

- $95 annual fee

More details:

- Earn 100,000 bonus points when you spend $15,000 within the first 3 months of opening your card

- Earn 3 times the points for all spending up to $150,000 each year

- Redeem your points through Chase Ultimate Rewards to ensure your points are worth 25% more

- Redeem your points for gift cards, travel, and cash back

- Enjoy the experience of fraud protection, zero liability, and purchase protection for every purchase you make using your card

The Chase Ink Business Preferred Card has an annual fee of $95, which is comparable to many of the other credit cards for travel. For the first $150,000 you spend on travel using your card, you receive 3 points for every dollar. After that, it is 1 point for every dollar.

If you spend $15,000 on your card within the first 3 months, you will receive 100,000 bonus points. All your points can be redeemed for cash back, gift cards, travel, and so much more. Your points will never expire, as long as your card is active. And if you redeem your points for travel through Chase Ultimate Rewards, your points will be worth 25% more.

Other features of this travel credit card include fraud protection, zero liability, and purchase protection.

To apply for the Chase Ink Business Preferred card, click here.

Pros - Hilton Honors Aspire Card

- 14 times the points on hotels and resorts

- 7 times the points on select travel and dining

- 3 times the points on all other purchases

- $250 airline fee credit

- $100 property fee credit

- Priority Pass Select membership

- Diamond Status at Hilton Hotels plus weekend night rewards

Cons - Hilton Honors Aspire Card

- $450 annual fee

More details:

- Earn 150,000 bonus points when you spend $4,000 on your card within the first 3 months

- Earn 14 times the points on all hotel and resort stays

- Earn 7 times the points on select travel and all dining expenses

- Earn 3 times the points on all other purchases

- Instant Diamond Status at Hilton Hotels plus weekend night rewards

- Priority Pass Select membership

- $250 airline fee credit

- $100 property fee credit

- No foreign transaction fees

The Hilton Honors Aspire Card is an American Express card, and it carries an annual fee of $450. At the moment, you can earn 14 times the points on hotels and resorts, 7 times the points on select travel and dining, and 3 times the points on all other spending.

During the first 3 months of opening your card, you can earn 150,000 bonus points when you spend $4,000 in purchases.

Other perks of this travel credit card include $250 airline fee credit, $100 property fee credit, complimentary Priority Pass Select membership, no foreign transaction fees, and car rental loss and damage insurance. You will also receive complimentary Diamond Status at Hilton Hotels and weekend night rewards.

To apply for the Hilton Honors Aspire card, click here.

These are the 10 best credit cards for travel in 2022. Not everyone can choose the same travel credit card. Some of us require best credit cards for international travel, while others prefer the best credit cards for travel rewards. Hopefully, you discovered one that can be helpful in saving you money, as you earn rewards while you are traveling the world!